Bitcoin down 2% for the week

Spread of fear of large-scale coin delisting

From June 14th to 21st, the virtual asset market fell slightly. As expectations spread that the United States would cut interest rates, the price of Bitcoin once exceeded $67,000. However, it fell again due to pressure from the German Federal Criminal Investigation Agency (BKA) to sell Bitcoin. According to Arkham, an artificial intelligence (AI)-based blockchain data platform, Germany’s BKA sold more than $195 million (about 270.9 billion won) worth of Bitcoin. Additionally, the U.S. Bitcoin spot exchange-traded fund (ETF) also recorded net outflows for four consecutive trading days, putting downward pressure on the Bitcoin price.

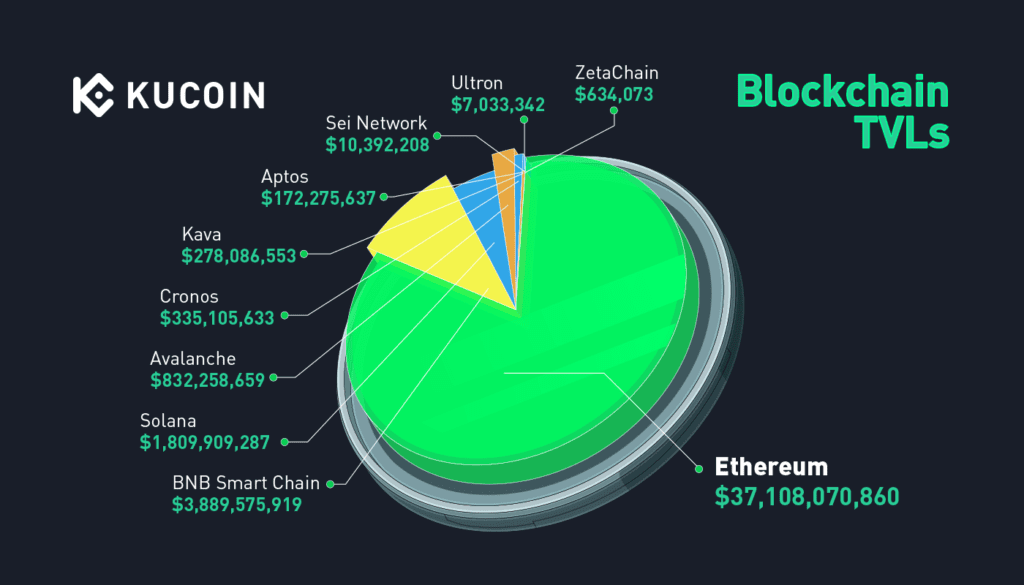

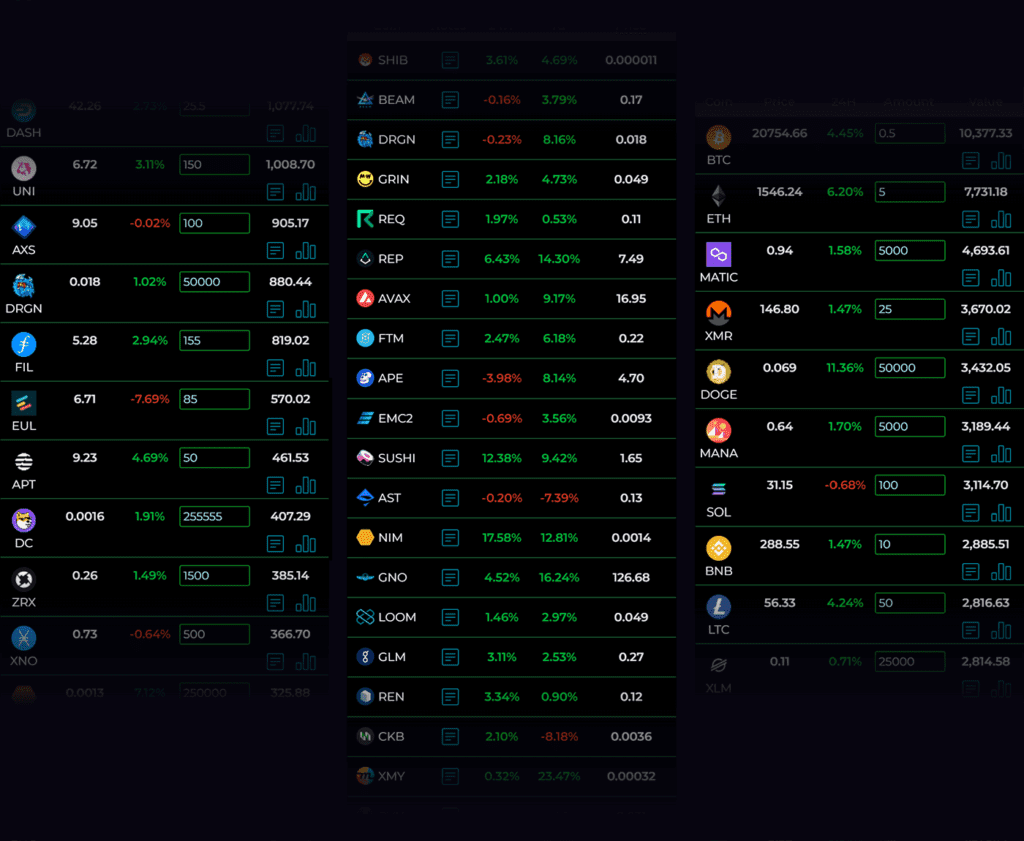

According to Xangle on the 22nd, the price of Bitcoin has fallen 2% over the week and is trading at around $65,000. During the same period, the market capitalization of the virtual asset market fell 3.1%. Ethereum price fell 1.3% over the week and is trading around $3,500. During the same period, altcoin prices recorded -2.1% for BNB, -9.3% for Solana, and -12.2% for Dogecoin.

Hwang Hyo-jun, a researcher at Xangle, said, “The virtual asset market fell slightly during the week with a decrease in purchasing power,” but added, “It is positive that the macroeconomic environment is improving.” Researcher Hwang said, “If employment indicators fall below expectations in the future, the interest rate cut period may be brought forward and demand for virtual asset investment may revive. As there are still expectations for the approval of the Ethereum spot ETF, there is still room for upside in the virtual asset market.” “He added.

Increased investor anxiety due to concerns about large-scale delisting from domestic exchanges

Due to the Virtual Asset User Protection Act, which takes effect on July 19, domestic virtual asset exchanges must review whether to maintain the listing of about 600 virtual assets currently being traded. Major exchanges plan to conduct an initial review to determine whether to maintain trading support. The screening criteria include the capabilities and social credit of the issuing, operating, and developing entity, disclosure of important information related to virtual assets, the possibility of virtual asset holders participating in decision-making, transparency of virtual asset operation, market capitalization, and appropriateness of virtual asset distribution, and virtual asset holders. This will include potential conflicts of interest, etc.

Recently, a list of ‘large-scale delisting (delisting) stocks’ was shared in online communities, and the price volatility of Bitcoin and other products has increased, increasing investor anxiety. In response to this, Upbit expressed anxiety by saying, “It is very unlikely that mass transaction support will end.”

Jangle researcher Joowon Lee said, “These strengthened regulations will increase market uncertainty in the short term, but in the long term, they will serve as positive changes that strengthen investor protection and market soundness.” Researcher Lee said, “Through strict screening standards, the quality of the overall market is expected to improve.”

Ethereum resolves securities controversy with end of US SEC investigation

The U.S. Securities and Exchange Commission (SEC) has suspended its investigation into the provision of Ethereum services by ConsenSys, the operator of the MetaMask wallet. The conclusion of this investigation can be interpreted as an indication that the SEC will not prosecute Ethereum sales for securities trading. For this reason, expectations are rising for the final approval of the Ethereum spot ETF.

Previously, the SEC investigated the allegation that ConsenSys brokered Ethereum, which had securities characteristics, through MetaMask (an unregistered securities provider). ConsenSys announced on social media on the 19th (local time) that the SEC had concluded its investigation into the provision of Ethereum services.

ConsenSys explained that the SEC’s cancellation of the investigation was related to the approval of the main documents of the Ethereum spot ETF. Additionally, it was reported that the cancellation of this investigation could be interpreted as meaning that the SEC will no longer view Ethereum as a security.

In the global virtual asset industry, the conclusion of this investigation is evaluated as a victory for ConsenSys. However, some are raising questions about whether it is unclear whether the SEC’s decision does not interpret Ethereum as a security or whether it does not consider ConsenSys’ brokerage activities to be securities sales.

We provide essential operation solutions based on on-chain data and trust-based community-building services to companies and foundations adopting Web 3.0. We operate Xangle, a crypto data intelligence platform, and the Xangle Research Team is creating content to show trends in the virtual asset investment industry based on global virtual asset information and data.