Foreigners net buy Samsung Electronics worth 520 billion won

Stock price recovered to 80,000 won in 10 days

Hanmi Semiconductor surged 7.7%

KOSPI rises 1.99%, close to 2700

“Semiconductor boom continues” VS “Temporary rebound”

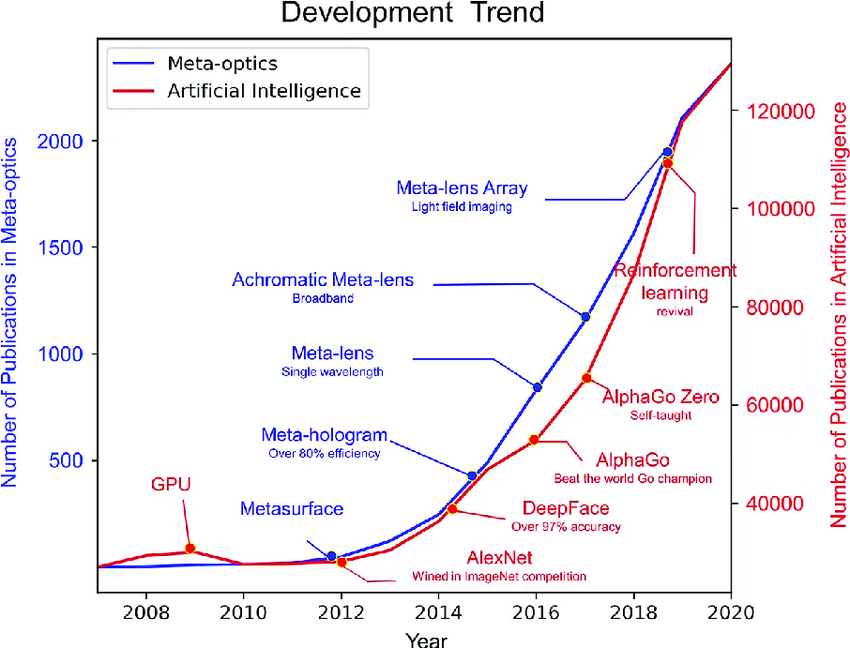

Foreign investors have returned to the domestic stock market as fears of a U.S. economic recession that were weighing down the global stock market have subsided. On the 16th, a large amount of spot goods worth over 1 trillion won were purchased in the stock market. The purchase funds are Samsung Electronics and SK Hynix It was focused on two sports. With the emergence of the ‘artificial intelligence (AI) bubble theory’, the criticism that it has lost its position as a leading stock market stockholder is becoming meaningless.

Experts argue that “AI and the semiconductor cycle have not yet reached their peak as global big tech’s determination to expand AI investment is firm” and that “the recent rise in AI stocks is nothing more than a mechanical rebound.”

Semiconductor stocks recovered from sharp decline

On this day, the KOSPI index closed at 2697.23, up 1.99%, approaching the 2700 level. Foreign investors led the upward trend. There was a net purchase of 1.2114 trillion won worth in the stock market. It has been about a month since foreigners bought more than 1 trillion won since the 5th of last month (1.313 trillion won worth).

Semiconductor stocks have also started to rebound. This is thanks to foreigners’ intensive purchase of semiconductor stocks. Net purchases of Samsung Electronics worth 520 billion won and SK Hynix worth 393 billion won were made.

On this day, Samsung Electronics finished trading at 82,000 won, up 3.89%, and rose again to ‘80,000 Electronics.’ SK Hynix closed at 199,700 won, up 6.96%. Hanmi Semiconductor also surged 7.76% on this day.

After the sharp drop on the 5th, Samsung Electronics rose 12.32% and SK Hynix rose 27.93%. The stock price rose 0.75% and 15.30%, respectively, compared to the trading day before the plunge.

It is analyzed that the reason foreigners have become ‘buyers’ of domestic semiconductor stocks is because expectations for a soft landing of the U.S. economy have grown as indicators that dispel concerns about an economic recession have been released one after another. US July retail sales ($709.7 billion) increased 1% from the previous month, and the number of new US unemployment claims last week (August 4-10) (227,000) decreased by 7,000 compared to the previous week. Jeong Yong-taek, a researcher at IBK Investment & Securities, said, “The scale of investment by U.S. Big Tech is important in the AI industry,” adding, “This means that AI-themed stocks have no choice but to ride the economy.”

Will semiconductor stocks reclaim their thrones?

The ‘AI bubble theory’ emerged as it was argued that the profitability of American Big Tech was too low compared to the astronomical investment. The logic was that if the economic downturn begins in earnest, the investment craze for AI, which is not easy to immediately generate profits, may cool down.

However, as AI-related stocks have recovered in price in recent days, some argue that “the bubble theory is premature.” As AI is likely to become a leading industry in the future, if you start reducing investment, you may be left out of the competition. Amazon, apple Major companies announced that they would increase investment in the AI industry.

Kim Dong-won, head of KB Securities Research Center, said, “Big Tech’s investment in AI-related facilities this year will reach the highest level in six years since 2018,” and added, “The increase in demand for high-capacity DRAM, centered on high-bandwidth memory (HBM), will continue until next year.” “He predicted.

In particular, the performance increase of domestic semiconductor companies is expected to be steep until the second half of this year. KB Securities predicted Samsung Electronics’ operating profit in the second half of the year to be 27.6 trillion won. It is predicted that the semiconductor industry will achieve its highest performance in three years in the second half of 2021 (KRW 29.7 trillion) when it was booming. SK Hynix (KRW 16 trillion) is also expected to record its highest performance in six years after 2018.

Some analysts say that the performance of semiconductor stocks is closer to a ‘technical rebound’ that follows a crash. The logic is that as it is difficult for the global economy to peak in the first half of the year and avoid a downward trend starting in the second half, the stock market has no choice but to transition into a structural downward trend. Researcher Jeong Yong-taek said, “This is the process of AI-related stock prices returning to a normal trend line after falling excessively due to concerns about an excessive economic downturn.”